The Dow Jones Rises 574.84 Points, its best day of 2024; U.S. and European Stocks Close Mostly Higher as the PCE Falls, Signaling Fed Rate Cuts

The U.S. and European stock markets closed mostly higher after investors responded to the lower PCE data. This fall in the PCE, a key inflation indicator, could potentially signal future rate cuts by the Federal Reserve. The Dow Jones responded to this news, gaining 574.84 points to record the best day of 2024. However, the Nasdaq’s large-cap tech stocks took a hit, ending Wall Street’s five-week rally.

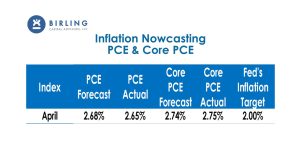

The PCE, a key measure of inflation, fell to 2.65%, down from 2.70% last month, and ahead of the Inflation Nowcasting of 2.68%. Similarly, the Core PCE, which excludes volatile food and energy prices, fell to 2.75%, down from 2.81% last month, and was just ahead of the Inflation Nowcasting of 2.74%. These declines, while keeping the core PCE above the Fed’s 2% target, suggest a stabilizing trend in inflation. Notably, the PCE is just 24.52% above the Fed’s 2% Inflation target rate.

Although core PCE remains above the Fed’s 2% target, stabilizing inflation indicators indicate that the Fed might proceed with one or two rate cuts later this year, potentially benefiting the broader economy and markets.

Asian markets showed mixed performance, while European indices moved higher as investors evaluated the latest euro-area inflation data, which reported an annualized rate of 2.6%, slightly surpassing expectations. Bond yields declined, with the 10-year Treasury yield closing at 4.51%. The U.S. dollar saw modest declines against major currencies.

Corporate earnings season is winding down, and the results are encouraging. 98% of S&P 500 companies reported that their first-quarter earnings results exceeded expectations. This is a positive sign for the market, indicating strong company performance and potential for future growth. Approximately 80% of these companies outperformed analyst forecasts, with an average surprise of 7.8%. Year-over-year earnings growth for the first quarter is 6%, the highest rate since Q1 2022. Projections indicate accelerating earnings growth, anticipated to reach 11% for the year.

Investors are looking forward to next week’s earnings reports from ExxonMobil Corp. (XOM), PulteGroup Inc. (PHM), General Motors Co. (GM), Advanced Micro Devices (AMD), Ford Motor Co. (F), Big Lots (BIG), CrowdStrike (CRWD), DocuSign (DOCU), and Dollar Tree (DLTR).

GDPNow Update:

- The GDPNow for the second quarter of 2024 was updated on May 31. It decreased to 2.70% GDP, down from 3.50%, a 22.86% decrease.

Key Economic Data:

- U.S. PCE Price Index YoY:fell to 2.65%, compared to 2.70% last month.

- U.S. Core PCE Price Index YoY: fell to 2.75%, compared to 2.81% last month.

- U.S. Personal Income MoM:fell to 0.27%, compared to 0.53% last month.

- U.S. Personal Spending MoM: fell to 0.20%, compared to 0.75% last month.

- Canada Real GDP QoQ: rose to 1.66%, compared to 0.07% last quarter.

- Germany Real Retail Sales YoY: rose to 1.80%, compared to -1.90% last month.

- Japan Housing Starts YoY:rose to 13.88%, compared to -12.79% last month.

Eurozone Summary:

- Stoxx 600: closed at 518.17, up 1.67 points or 0.32%.

- FTSE 100: closed at 8,275.38, up 44.33 points or 0.54%.

- Dax Index: closed at 18,497.94, up 1.15 points or 0.01%.

Wall Street Summary:

- Dow Jones Industrial Average: closed at 38,686.32, up 574.84 points or 1.51%.

- S&P 500: closed at 5,277.51, up 42.03 points or 0.80%.

- Nasdaq Composite: closed at 16,737.01, down 2.06 points or 0.01%.

- Birling Capital Puerto Rico Stock Index: closed at 3,365.30, up 31.38 points or 1094%.

- Birling Capital U.S. Bank Stock Index: closed at 5,115,85, up 0.13 points or 0.13%.

- U.S. Treasury 10-year noteclosed at 4.51%.

- U.S. Treasury 2-year note closed at 4.89%.