Global Market Square – Rising Bond Yields Pressure Global Stocks, US and European Markets Tumble, First-Quarter Earnings Wrap-Up

The U.S. and European stock markets closed lower, driven by rising bond yields that curbed investor risk appetite. Every sector in the S&P 500 experienced declines, highlighting a widespread shift in sentiment, and the Dow Jones has lost so far this week 660.77 points. The 10-year Treasury yield rose to 4.61%, spurred by lackluster Treasury auctions on Tuesday and hawkish comments from the Federal Reserve, which signaled that interest rates might need to stay elevated longer to combat inflation. Overseas, Asian markets mostly declined overnight, and European markets also finished lower, influenced by mixed inflation data from Germany.

As the first-quarter earnings season draws to a close, about 96% of S&P 500 companies have reported their results, with earnings expected to grow approximately 6% year-over-year. This would represent the most significant quarterly growth rate since Q2 2022. Key sectors driving this growth include information technology, communication services, and consumer discretionary, each poised for over 20% year-over-year earnings growth. Utilities are anticipated to see a notable 30% increase in first-quarter earnings, while the financial sector is expected to grow by 9.4%. For the entire year, S&P 500 earnings are projected to rise by just over 11%, with most sectors forecasted to see positive growth. Current economic conditions are expected to support continued corporate profit growth, which should benefit stock performance in the months ahead.

Despite the “sell in May and go away” adage, this month has proven vital for investors. The S&P 500 has risen over 5% through Tuesday’s close, setting it up for the best month since November 2023. Small-cap and mid-cap stocks have also performed well, with the Russell 2000 Index up 4.7% and the Russell Mid-cap Index up 2.6% during the same period. Internationally, developed and emerging-market stocks have shown strength, with the MSCI EAFE and MSCI EM Indexes gaining around 4% in May. Following a tough April, when U.S. investment-grade bonds fell by 2.5%, the Bloomberg U.S. Aggregate Bond Index has rebounded, rising approximately 1.3% in May. While U.S. economic growth may slow, it is expected to remain positive, creating a favorable environment for equities in the coming months.

Our opportunistic asset-allocation strategy recommends that clients underweight U.S. investment-grade bonds and overweight U.S. mid-cap stocks to align with their long-term goals. Additionally, we favor the quality and momentum of U.S. large-cap stocks over emerging-market stocks and prefer emerging-market debt to U.S. high-yield bonds.

Key Economic Data:

- Germany Consumer Price Index YoY: rose to 2.40%, compared to 2.20% last month.

- Richmond Fed Manufacturing Index: rose to 0.00, up from -7.00 last month.

Eurozone Summary:

- Stoxx 600: closed at 513.45, down 5.63 points or 1.08%.

- FTSE 100: closed at 8,183.07, down 71.11 points or 0.86%.

- Dax Index: closed at 18,473.29, down 204.58 points or 1.10%.

Wall Street Summary:

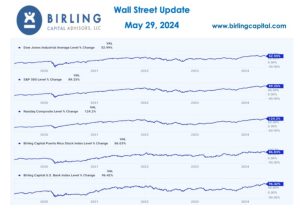

- Dow Jones Industrial Average closed at 38,441.54, down 411.32 points or 1.06%.

- S&P 500 closed at 5,266.95, down 39.09 points or 0.74%.

- Nasdaq Composite closed at 16,920.58, down 99.30 points or 0.58%.

- Birling Capital Puerto Rico Stock Index closed at 3,371.10, down 17.09 points or 0.50%.

- Birling Capital U.S. Bank Stock Index closed at 5,168.89, down 44.33 points or 0.85%.

- U.S. Treasury 10-year note closed at 4.61%.

- U.S. Treasury 2-year note closed at 4.96%.